On Thursday, May 15, Governor Pence announced ‘HIP 2.0,' the proposed Indiana alternative to the Medicaid expansion. A long time coming, this will affect the 1.2 million Hoosiers who fall below the Federal Poverty Level (FPL) and an additional 440,000 who fall between the 100% and 138% of the FPL.

Until the middle of June, the public is invited to comment on HIP 2.0. At the end of this article, I’ll tell you what I think you should consider communicating to Pence’s office, but first a little about the plan and how it will work.

Any Hoosier who qualifies for HIP will be assigned a POWER Account. This works a lot like your standard HSA account, but with a couple of important differences. First, every HIP 2.0 Hoosier’s contribution will be income dependent (ranging from $36 to $300 per year) with a supplement by the state to get the account balance up to $2,500 each year.

Hoosiers above the FPL (about $11,670/year for an individual) have a powerful incentive to pay into their POWER Account. If they keep paying into the POWER account, their out-of-pocket costs for health care are kept to a maximum of $300/year. If they fail to make payments, they will get kicked out of HIP 2.0 and be forced to buy insurance on the exchanges. On the exchanges, these Hoosiers’ out-of-pocket expenses could crest $2,700/year.

For Hoosiers below the FPL, the incentives are more complicated. If they fail to make payments into their POWER account, they do not get kicked out of HIP 2.0. Instead, they are forced into a different insurance plan within HIP. This different – and less attractive – insurance plan (called HIP Basic) includes three substantive differences. One of these differences (a lack of vision and dental coverage) provides a pretty powerful incentive for individuals to contribute to their accounts, but the other two (added out-of-pocket co-pays and no contribution roll-overs) are relatively useless as incentives. Here’s why:

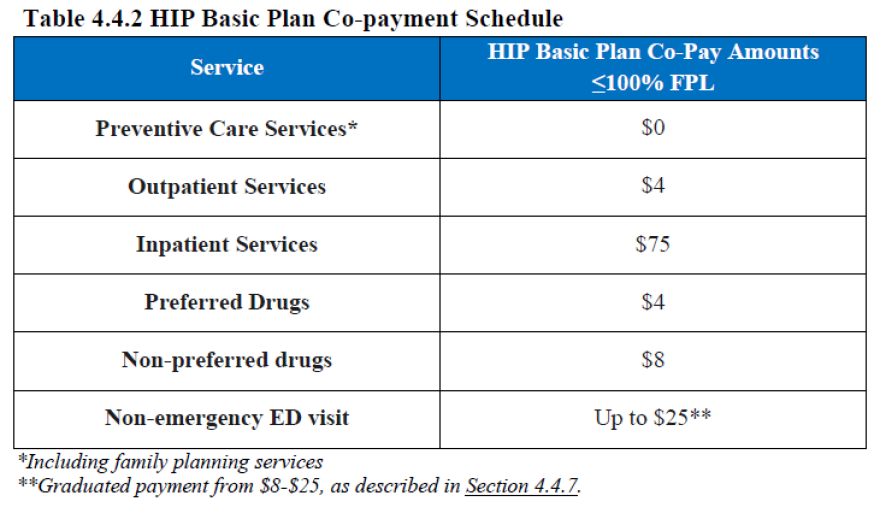

Out-of-Pocket Co-Pays

These added co-pays are listed in Table 2. For Hoosiers with incomes between 23% and 100% of the poverty level, paying the out-of-pocket costs is probably a better deal than paying their monthly contribution to the POWER Accounts.

Hoosiers who fall between 23% and 50% of the poverty level have to pay $96/year to avoid the out-of-pocket co-pays. But if they save that $96 and apply it to the co-pays they have to pay instead, they could have 20 outpatient procedures and preferred prescriptions and still have money left.

For those who make between 51% and 100% of the FPL, the incentive is even lower—their required contributions to the POWER Accounts is $180/year, which is more expensive than two inpatient hospital visits and 7 outpatient surgeries. Thus, out-of-pocket costs provide zero incentive for these Hoosiers to contribute to their POWER accounts.

No Roll-Over

Hoosiers below the FPL who fail to make contributions to their POWER Accounts will not be allowed to rollover any of their previous contributions to future years. Setting aside the fact that the roll-over equation is complicated and uncertain, the idea of the roll-over depends on HSA-style incentivizing. It’s trying to encourage HIP members to spend less on healthcare by putting them on the hook for some of the costs. As I’ve noted before, these incentives are currently fundamentally flawed (they ask non-experts to make expert judgments) and are useless in the current health care billing environment.

Dental and Vision Plans

The third difference between HIP 2.0 and HIP Basic provides the only good reason for members below the FPL to contribute to their Power Accounts. Hoosiers below the FPL who fail to make their contributions to their POWER Accounts will lose their dental and vision coverage. As anyone who goes to the dentist or has to pay for glasses or contacts knows, $36/year is a steal for dental cleanings and glasses, $96/year is a deal, and $180/year is likely worth it. This incentive might just work.

And this brings us to the question I have: Do we, as Hoosiers, think it’s a good idea to incentivize vision and dental insurance this way? Do we think that someone who makes $2,600/year (22% of the FPL) should lose his vision and dental coverage if he doesn’t pay $36 into his Power Account? Do we think someone who makes around $5,836/year (50% of the FPL) should lose their vision and dental coverage if they don’t pay $180?

If you think that Hoosiers below the FPL should have vision and dental coverage whether they have the money to contribute this month or not, here’s what you should tell Pence before the June 13 deadline: HIP 2.0 should be one plan. That plan should include vision and dental coverage, and everyone below the FPL should be on it.

Abraham Schwab is an associate professor of philosophy and medical ethicist at IPFW.

Opinions expressed in this column are those of the individual writer and do not necessarily reflect the opinions of the staff, management or board of Northeast Indiana Public Radio. If you want to join the conversation, head over to our Facebook page and comment on the post featuring this column.